Forex trading involves buying and selling currencies, but not every currency exchange needs to happen in person. Forex trading apps let you do your business from anywhere in the world, even if you don’t have access to traditional trading platforms. Forex trading apps are convenient and even allow you to trade on the go, but they also come with some limitations that can make them impractical for many traders. Keep reading to learn about the pros and cons of forex trading apps, so you can decide whether or not they’re right for you.

What are some benefits of using forex trading apps

Some forex trading apps allow you to access quotes, charts, and news sources. Others have calculators that enable you to make quick-and-easy trades. They are also very user friendly and convenient. Plus, some offer real-time push notifications so you know when it’s time to act on a trade or market move. If you don’t want to be glued to your computer screen all day long waiting for something to happen, then a forex trading app might be for you.

What are some disadvantages of using forex trading apps

Like anything else in life, there are a few downsides to using a forex trading app. You may find that you are not getting nearly as many trades as you think you should be with your app. It might be simply because there are so many other apps on the market that it is hard to gain any traction for your own. Another disadvantage is that sometimes these programs aren’t quite as simple or seamless as some traders may like, particularly if they aren’t tech-savvy.

How to use forex trading apps to successfully trade on the go

As with everything in life, using a forex trading app means balancing benefits against drawbacks. It’s not a one-size-fits-all kind of thing, but when done right, you can still take advantage of an app’s benefits while minimizing any potential drawbacks. To get started, simply install a couple different forex trading apps and try them out to see which one feels right for you.

Things you should know about Admiral Markets Review

The forex market, which stands for foreign exchange market, is the largest and most liquid market in the world, with an average daily trading volume of over $4 trillion. If you want to invest in the market, you must have enough information about it before you start trading it in order to succeed, and admiral markets review can provide all the necessary information so that you can make the right decision when it comes to choosing the right forex broker to trade with.

Trading platform

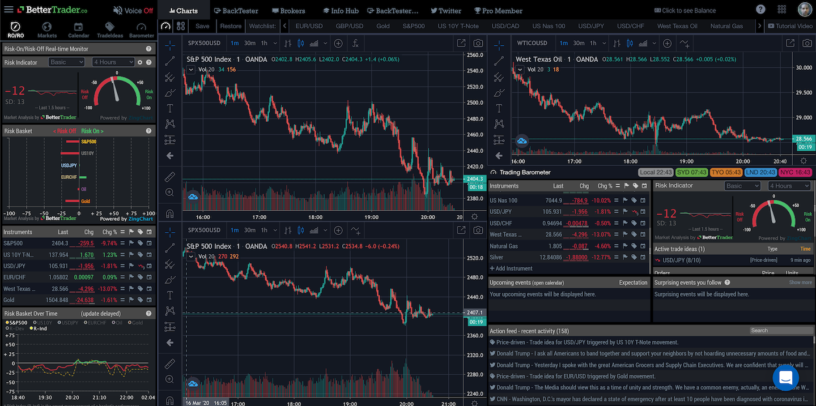

To make money in currency trading, it’s important to find a trading platform that is both user-friendly and provides access to a variety of market data. You want a platform that offers solid charting and trade alerts, as well as good customer service. Any of these platforms will get you started on your way to making money with currency trading Admiral markets online trading by STP broker let you enter trades much faster than most other brokers which are only available through MT4 due to binary broker network architecture.There’s also top brand instruments across all major asset classes, including forex (cryptocurrencies included), commodities, futures, stocks and indices.

Deposits and withdrawals

Our goal is to have a solid relationship with our clients, and we have great customer service for all of your inquiries. The Admiral Markets website is simple and easy to use, so feel free to place your deposit at any time. Withdrawals are instant if requested before 6:00 pm CET on any given business day and will be processed within 2 working days during non-business hours, meaning they will reach your account within 4 working days.

Customer support

Admiral Markets’ customer support is easily accessible via phone, email, and online chat. There’s also a company helpline to call in case of emergencies. The broker is also very active on social media platforms like Facebook and Twitter. Traders can get in touch with Admiral Markets’ management via LinkedIn, though it may take some time for an admin to respond since the company is so big.